The Mortgage Paperwork Checklist: Exactly What You’ll Need (With Real Examples)

"Wondering Why I’m Asking for These Documents? Or What They Even Look Like?"

So… we’ve had a quick chat about your mortgage goals. Now you’ve got a document list in your inbox—either for your pre-approval or because your lender’s underwriter is asking for more info.

If you’re looking at the list thinking, “Wait… what’s a NOA? What does a Gift Letter even look like?”—you’re in the right place.

This is your one-stop hub for sample mortgage documents:

✅ What each one looks like

✅ Why lenders ask for it

✅ Where you can get it

Heads up: Not every document here will apply to you.

During our next call, I’ll help you figure out exactly which ones matter for your situation.

Skip the Guesswork. Jump to What You Need 👇

Because hunting through a giant wall of text sucks...

👉 Income Verification Docs

👉 Proof of Down Payment & Assets

👉 Property Details (For Buyers, Sellers & Refinancers)

👉 ID Requirements

👉 Self-Employed / Business Owner Docs

👉 Situational Stuff (That Only Applies to Some People)

Not sure what’s relevant for you? No worries. Just scroll... I’ll break it all down for you below.

Section 1: Income Verification

These documents prove to lenders that you have enough steady income to make your mortgage payments.

Full T1 Generals (for rental income or self-employed borrowers)

What it is:

Your full personal income tax return showing total income, deductions, and breakdowns (like rental or self-employed income). We usually need your most recent 2 years. And yes, we know it’s very long! Depending on your particular situation, it could be over 100 pages long - the pdf version of it is perfectly fine! No need to cut down a whole tree for your mortgage.

Why lenders need it:

To verify your income over the past 1–2 years and assess consistency, especially for non-salaried income streams.

Where to get it:

Your accountant or your self-serve tax filing program.

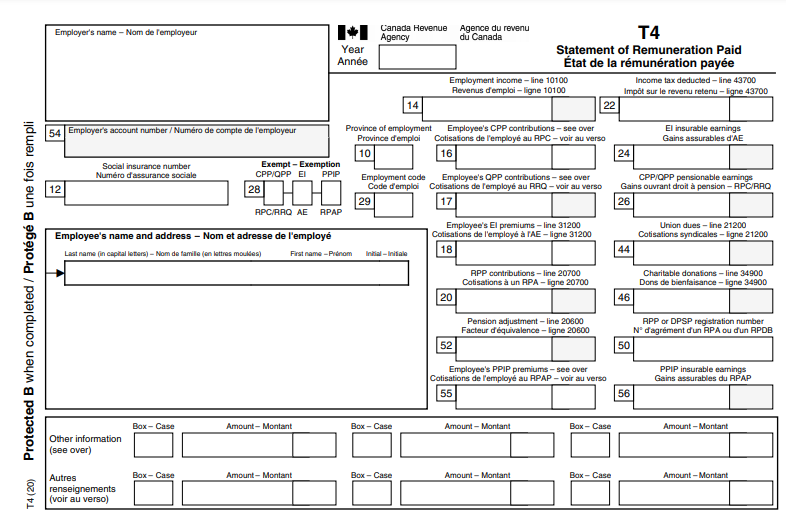

What it is:

A summary of your annual employment income and deductions, provided by your employer. Usually one page or so. You’ll receive one from each employer

Why lenders need it:

To confirm your total employment income from the previous years. Usually we request 2 most recent years of T4s to prove history.

Where to get it:

From your employer (typically issued each February). You can get reprints through HR, or they may direct you to your e-post inbox to find it once more.

T4A (Government & Pension Income – CPP, OAS, Disability, etc.)

What it is:

A statement showing government benefit income. You would receive it if you received any of the following benefits:

Retirement benefit

Survivor benefit

Disability benefit

Child benefit

Death benefit

Post-retirement benefit

Why lenders need it:

To confirm non-employment income that you want to use to qualify.

Where to get it:

CRA MyAccount or Service Canada.

T5 (Investment Income)

What it is:

A slip showing income earned from investments like interest, dividends, or capital gains.

Why lenders need it:

If you’re using investment income to help qualify for your mortgage.

Where to get it:

From your bank, investment advisor, or CRA MyAccount.

Notice of Assessment (NOA)

What it is:

The official summary from CRA showing how much income you reported and how much tax you owe or have paid.

Why lenders need it:

To double-check your reported income and confirm no outstanding tax balances (tax arrears can derail approvals).

Where to get it:

CRA MyAccount → "Tax Returns" → "Notices of Assessment".

Canada Child Benefit (CCB) Statement

What it is:

Monthly benefit details showing your child benefit payments.

Why lenders need it:

If you’re counting CCB as qualifying income.

Where to get it:

CRA MyAccount

Job Letter (Letter of Employment)

What it is:

An official letter from your employer confirming your job title, start date, employment status (full-time/part-time), and income, as well as guaranteed hours per week.

Why lenders need it:

To confirm job stability and income details.

Where to get it:

Ask your HR department. (We can provide a sample template.)

Recent Pay Stubs

What it is:

Proof of your current pay, showing your year-to-date earnings and deductions.

Why lenders need it:

To confirm your current earnings match your job letter and T4s.

Where to get it:

Your employer’s payroll department or your online payroll portal.

Pension Statement

What it is:

A document showing monthly or annual pension income amounts.

Why lenders need it:

To confirm retirement income if you’re using it to qualify.

Where to get it:

Your pension plan provider (if private pension) or Service Canada (government pension).

WSIB Statement

What it is:

Details on Workers’ Compensation income from a workplace injury. This letter would be drafted by your case manager and should outline that your injury is permanent/long term, and that the WSIB benefits will be paid for the foreseeable future.

Why lenders need it:

If using WSIB benefits as part of your qualifying income.

Where to get it:

WSIB or your case manager.

Section 2: Down Payment and Asset Verification

Lenders want to know where your down payment is coming from—and that it’s legit. You should be able to follow the money trail and explain where the funds are from.

I say this as someone making $40k a year at 25 years old may be asked how they accumulated $500k in savings for their down payment, even if you’re able to follow it for the requisite amount of time that the bank would traditionally ask.

Proof of Deposit (90-Day Bank History)

What it is:

Bank statements showing a full 90-day history of your account where the down payment is coming from. If your money has moved between 3, 4 or even 5 bank accounts in that 90-day period, be prepared to provide all those statements and explain any unusual deposits.

Why lenders need it:

To meet anti-money laundering (AML) requirements and confirm the money is yours.

Where to get it:

Download directly from your online banking platform.

Gift Letter

What it is:

A signed letter confirming that your down payment gift is from an immediate family member and does not need to be repaid.

Why lenders need it:

To document the source of gifted funds.

Where to get it:

We’ll provide you with a lender-approved template.

Section 3: Property-Related Documents

To help lenders verify property value, condition, and associated costs.

MLS Listing

What it is:

A realtor-provided listing showing property details, photos, and listing price.

Why lenders need it:

To verify the property being purchased aligns with the purchase agreement.

Where to get it:

Your realtor.

Purchase Agreement (Offer to Purchase)

What it is:

A legally binding contract showing the agreed purchase price and conditions.

Why lenders need it:

To finalize the loan amount and structure.

Where to get it:

Your realtor.

Sale Agreement (if selling a property)

What it is:

Proof of your property sale and how much you’ll receive.

Why lenders need it:

If proceeds from the sale are being used for your down payment or debt reduction.

Where to get it:

Your realtor.

Mortgage Statement (for refinances or existing homes)

What it is:

Your most recent mortgage account summary showing balance, rate, and maturity date.

Why lenders need it:

To calculate refinancing terms or consolidate existing debts.

Where to get it:

Your lender—online portal or by phone.

**Added bonus! We’ll monitor your rates and maturity date, and work with you on your other properties to ensure you’re getting the best rate and product at renewal.

Property Tax Statement

What it is:

A record of your current property tax bill and payment history.

Why lenders need it:

To verify annual property taxes for debt servicing calculations.

Where to get it:

Your city/township property tax office or online tax portal.

Status Certificate (for Condos – Ontario Only)

What it is:

An official document that gives a full snapshot of the condo building’s financial health and any potential issues. It includes details about monthly condo fees, reserve funds, upcoming special assessments, insurance, legal matters, and the unit’s standing within the building.

Why lenders need it:

To confirm the building is financially stable and that there are no red flags (like pending lawsuits or massive fee increases) that could affect your ability to repay the mortgage.

Where to get it:

If you’re buying: Your realtor will request it from the condo’s property management company.

If you already own the condo (for refinancing): Contact your condo’s property management office directly.

How long it takes:

Up to 10 business days from the date it’s ordered—so don’t leave this one until the last minute.

Section 4: Identification

To verify your identity and meet anti-fraud and anti-money laundering laws.

Driver’s License

Where to get it:

ServiceOntario or your province’s licensing office.

Passport

Where to get it:

Passport Canada.

Permanent Resident (PR) Card

Where to get it:

Immigration, Refugees and Citizenship Canada (IRCC).

Government-Issued Photo ID

Where to get it:

Your provincial government service office.

Section 5: Self-Employed / Business Owner Docs

If you own a business or earn self-employment income, here’s what lenders will need.

Articles of Incorporation

What it is:

Official document showing your business registration.

Why lenders need it:

To prove business ownership.

Where to get it:

Corporate registry office or your lawyer.

Business License

What it is:

Your business operating license.

Why lenders need it:

For sole proprietorships or small businesses.

Where to get it:

Your city or municipal licensing office.

Company Financial Statements

What it is:

Your company’s profit and loss statement and balance sheet.

Why lenders need it:

To verify business income stability.

Where to get it:

Your accountant.

T2 Corporate Tax Returns

What it is:

Your business’s corporate tax filings.

Why lenders need it:

To assess your company’s financial health.

Where to get it:

Your accountant.

Full T1 Generals

What it is:

A schedule detailing all of your personal income

Why lenders need it:

To confirm your self-employed income, rental income, other income - basically a “master sheet” of everything income pertaining to you. Please note: We cannot accept the condensed version - the Full version will still be required.

Where to get it:

Your accountant.

Section 6: Other Situational Documents

Divorce or Separation Agreements

What it is:

Court-certified documents showing division of assets, support obligations, etc.

Why lenders need it:

To account for support payments or property settlements.

Where to get it:

Your lawyer or family court.

Child or Spousal Support Documentation

What it is:

Legal proof of support payments you make or receive. This may be a moot point if your Divorce/Separation agreement already highlights this, however if things have changed after the agreement was set in place, we need to see the most updated documents.

Why lenders need it:

To include or deduct from your debt ratios.

Where to get it:

Your lawyer or court documents.

Bankruptcy/consumer proposal Discharge Papers

What it is:

Proof that a past bankruptcy has been discharged.

Why lenders need it:

To confirm you’ve satisfied bankruptcy requirements, and confirmation of when the bankruptcy/consumer proposal was discharged.

Where to get it:

Licensed Insolvency Trustee.

Birth Certificate (if using CCB income)

What it is:

Proof of your child’s age and eligibility.

Why lenders need it:

If you’re counting CCB as qualifying income.

Where to get it:

Provincial Vital Statistics Office

“Not Sure Which Docs You Actually Need?”

Look… I get it.

This list can feel overwhelming.

The good news? You don’t need all of these.

Your exact document list depends on your job, income type, property type, and lender requirements.

That’s why I’ll create a custom, personalized document checklist for you.

👉 Based on your specific mortgage scenario

👉 Focused only on the docs that apply to you

👉 Designed to help you avoid delays and get approved faster

Click below to tell me about your situation—and I’ll send you your tailored doc list.

At VeloMortgage.ca, we help homebuyers and homeowners across Canada get mortgage approvals with less stress and faster turnaround times. Whether you’re buying your first home, refinancing, or renewing, we’ll help you get your paperwork right the first time.