Fauquier‑Strickland, ON ran out of Money: What Homeowners Should Know

Fauquier-Strickland, Ontario, population 530, just made national headlines - not for a festival or natural disaster, but for something that hits even closer to home:

The small, primarily francophone township is broke.

They’re laying off all municipal staff.

Halting all services.

And warning residents of a possible 300% property tax hike unless something changes.

Keep in mind: most residents are seniors on fixed incomes

For most Canadians, it sounds surreal, but this is real. And if you own a home there (or in any small township), here’s what you need to know.

What Happened?

Over the last few years, the township racked up more than $2.5 million in debt, far beyond what it can repay through property taxes. The causes are still under review - but mismanagement, inflated spending, and a shrinking tax base all played a role.

With no cash to cover operations, council voted to:

Lay off all staff

Pause all services (garbage, road maintenance, snow removal - even fire and mutual aid services could be at risk)

Explore shutting down the township altogether by August 1

The township applied for a $2M loan with the bank, however the documentation requested won’t be available until 2026 - even if this did go through, it’s still a spike of 26% of property taxes to habitants of Fauquier-Strickland.

Mayor Madeleine Tremblay has been requesting help for years from the ministry - to no avail.

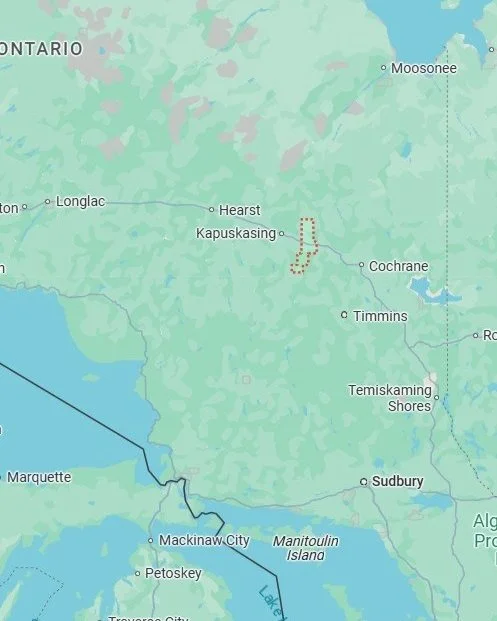

Township of Fauquier-Strickland Photo

What This Means for Homeowners

1. Essential Services Will Be Interrupted - But Not Forever

Yes, garbage, road work, snow removal, and local governance are paused. But here’s the part that’s important:

The province won’t let basic infrastructure fail completely.

Ontario will likely step in through temporary receivership or by assigning service contracts to neighbouring municipalities or districts.

You may experience slower response times, fewer local programs, and limited access to officials - but you won’t be left with overflowing trash or crumbling roads long-term.

2. A Tax Spike Is on the Table

To stay solvent, the township warned it would need to triple local property taxes - something most homeowners simply can’t afford.

If the province intervenes, they may avoid such a steep hike by:

Merging Fauquier-Strickland with a nearby township

Imposing a managed debt recovery plan over several years

Or providing conditional grants for service continuity

But until there’s a formal plan, tax increases are still a possibility.

3. Home Values Could Take a Temporary Hit

Uncertainty hurts buyer confidence.

Even though the long-term impact may be minimal, expect slower sales, fewer offers, and more price sensitivity while the township sorts itself out.

4. Mortgage Servicing May Need Adjustment

If your tax obligations rise or services change, contact your mortgage lender or broker. You may be eligible for:

Reassessments on tax holdbacks

Temporary deferral or restructuring

Updated property value evaluations if refinancing

5. Long-Term? It’ll Likely Be Business as Usual (Eventually)

Small-town dissolutions are rare in Ontario - but not impossible.

If Fauquier-Strickland can’t pay its bills, the township may be absorbed into a neighboring municipality. Residents would still get services, but likely under a new name, council, and tax structure.

In other words, the township may disappear, but your home won’t.

Final Thoughts: What You Should Do Now

If you own a home in Fauquier-Strickland or any small rural township:

Stay informed – follow council meetings and media briefings - Next meeting scheduled July 14, 2025

Watch your property tax assessments – and budget for potential hikes

Contact a mortgage professional – especially if you’re tight on cash flow

Don’t panic-sell – most municipal disruptions are temporary

Want clarity on how this affects your home or mortgage?

Book a free call and I’ll walk you through your best options.

Jeff Dinsmore

Mortgage Broker